Are you feeling overwhelmed by your credit score? You’re not alone. For many, understanding and managing credit can feel like navigating a maze. Enter Qlcredit—a game-changing solution designed to demystify the world of personal finance and help you take control of your financial future. Whether you’re looking to secure a loan, buy a home, or simply improve your financial health, grasping how Qlcredit works could be the key to unlocking opportunities you never thought possible. Let’s dive into what makes this platform stand out and why it might just be the answer you’ve been searching for.

What is a Credit Score and Why Does It Matter?

A credit score is a numerical representation of your creditworthiness. Ranging from 300 to 850, this three-digit figure reflects how well you manage debt. Lenders use it to gauge the risk involved in lending money or extending credit.

Understanding your credit score is crucial because it influences many aspects of your financial life. A higher score can lead to lower interest rates on loans and better terms for mortgages and credit cards. Conversely, a low score might result in rejection or higher rates.

Beyond just securing loans, good scores impact insurance premiums and even job opportunities in some sectors. It’s not just about borrowing; it’s about shaping your financial future with confidence. Monitoring and improving your score can open doors that would otherwise remain closed.

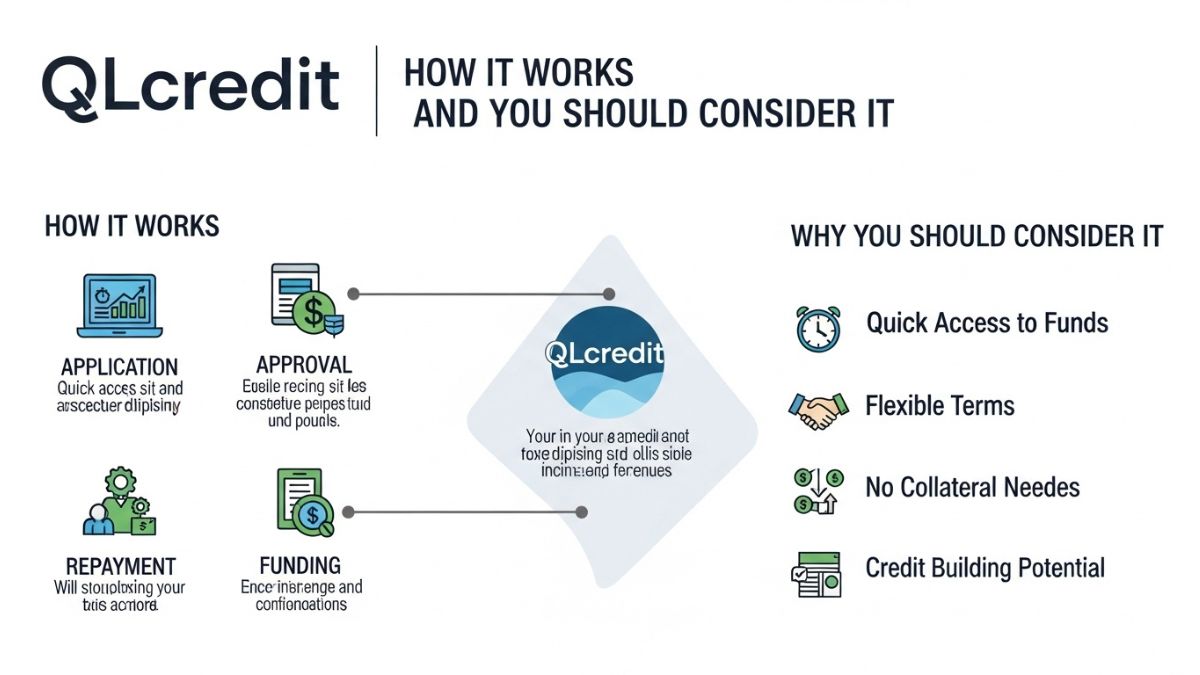

How Qlcredit Works to Improve Your Credit Score

Qlcredit operates by providing personalized insights into your credit profile. It analyzes various factors that contribute to your overall score, such as payment history and credit utilization.

Through its user-friendly platform, Qlcredit identifies areas for improvement. You’ll receive tailored recommendations designed to enhance your score over time.

One standout feature is the ability to monitor changes in real-time. As you implement suggested strategies, you can see how they positively affect your credit standing.

Additionally, Qlcredit offers educational resources to help users understand the intricacies of credit scoring systems. Knowledge empowers you to make informed financial decisions moving forward.

With a focus on actionable steps and ongoing support, Qlcredit helps turn your credit challenges into opportunities for growth. This proactive approach makes it easier than ever to achieve a better financial future.

Benefits of Using Qlcredit

Using Qlcredit offers several key advantages for anyone looking to boost their financial health. One of the primary benefits is its user-friendly interface. Navigating through your credit options becomes seamless, making it easier to track improvements over time.

Another notable advantage is personalized guidance. Qlcredit tailors recommendations based on your unique financial situation, ensuring you receive relevant advice that aligns with your goals.

Moreover, leveraging technology enhances efficiency. Automated updates keep you informed about changes in your credit score and offer actionable insights without overwhelming you.

Additionally, Qlcredit provides educational resources. Users can access articles and tips designed to demystify credit management, empowering them to make informed decisions effortlessly.

Securing loans or favorable interest rates becomes more achievable with a better credit score. As users implement Qlcredit’s strategies, they often find improved accessibility to essential financial products that align with their needs.

Common Misconceptions about Qlcredit

Many people hold misconceptions about Qlcredit that can deter them from exploring its benefits. One common myth is that using Qlcredit will negatively impact your credit score. In reality, it’s designed to help you build and improve your credit over time.

Another misunderstanding is that Qlcredit only caters to individuals with poor credit history. This isn’t true; even those with good scores can benefit from the services offered.

Some believe that signing up for Qlcredit comes with hidden fees or complicated terms. However, transparency is a priority for this platform, ensuring users know what they’re getting into without any surprises.

Many think the process of improving one’s credit through Qlcredit takes forever. While results may vary based on individual circumstances, many users report quick improvements after implementing recommended strategies.

How to Get Started with Qlcredit

Getting started with Qlcredit is simple and straightforward. First, visit their official website to create an account. You’ll need to provide some basic personal information, including your name, address, and Social Security number.

Once registered, you can access various tools designed to assess your creditworthiness. Qlcredit offers a free credit report along with tailored recommendations for improving your score.

Next, take advantage of any educational resources available on the platform. Understanding how credit works will empower you in managing it effectively.

After familiarizing yourself with the platform, set specific goals regarding your credit score. This could involve paying down existing debts or disputing inaccuracies on your report.

Regularly monitor your progress through Qlcredit’s dashboard. Stay engaged and adjust strategies as needed while tracking improvements over time.

Conclusion

Qlcredit offers a promising way to enhance your credit score and manage your financial health. By understanding the intricacies of credit scores, you can see why improving yours is so vital. Qlcredit simplifies this process, making it accessible for everyone.

With its unique approach to credit improvement, users can experience significant benefits such as better loan terms and lower interest rates. Many people harbor misconceptions about tools like Qlcredit, but with the right information, these myths can easily be debunked.

Starting with Qlcredit is straightforward and user-friendly. With clear steps laid out for you, taking charge of your credit score has never been easier. If you’re looking for an effective solution to boost your financial standing, it’s worth considering what Qlcredit has to offer.