Managing personal finances can often feel overwhelming. With bills to pay, debts to manage, and savings goals to meet, many people struggle to keep everything organized. Enter QLCredit a game-changing tool designed for today’s financial landscape. This innovative platform not only simplifies personal finance management but also empowers users with insights that foster better decisions. Whether you are trying to budget more effectively or track your spending habits, QLCredit offers a fresh approach tailored just for you. Let’s dive deeper into what makes this platform stand out in the crowded world of financial tools and how it could transform your money management journey.

What is qlcredit?

QLCredit is an innovative platform designed to help users manage their personal finances effectively. It provides a comprehensive suite of tools aimed at simplifying budgeting, tracking expenses, and enhancing financial literacy.

At its core, QLCredit stands out with its user-friendly interface. The design makes navigation effortless for individuals at any level of financial expertise. Whether you’re a novice or a seasoned money manager, the setup caters to your needs.

This platform also emphasizes real-time data analytics. Users can access insights into spending habits and savings patterns instantly. This feature enables informed decision-making regarding future financial strategies.

Additionally, QLCredit integrates seamlessly with various bank accounts and credit cards. This connectivity ensures that all transactions are monitored in one place without manual inputting of information. It’s about making finance management intuitive and straightforward for everyone involved.

The Benefits of Using QLCredit

Using QLCredit brings a wealth of advantages to your personal finance management. One standout benefit is its user-friendly interface, which makes navigation intuitive. You can easily track expenses and income without feeling overwhelmed.

Another key advantage is the real-time insights it provides. Users gain access to instant analytics on spending habits, allowing for informed financial decisions. This level of visibility helps you adjust your budget effectively.

Additionally, QLCredit offers personalized recommendations tailored to individual financial goals. Whether you’re saving for a vacation or paying off debt, this feature empowers users to take charge of their finances confidently.

The platform also emphasizes security. With advanced encryption measures in place, you can manage your money without worrying about data breaches or unauthorized access.

In essence, using QLCredit not only simplifies budgeting but also enhances overall financial wellness through its thoughtful features.

How QLCredit Works

QLCredit simplifies personal finance management with a user-friendly interface. When you sign up, you link your bank accounts and credit cards securely. This integration allows QLCredit to analyze your financial habits seamlessly.

The platform categorizes expenses automatically. By doing so, it provides insights into spending patterns that might be surprising. You can view monthly trends, helping identify areas where adjustments can be made.

Budgeting becomes effortless with QLCredit’s customizable features. Set specific goals for savings or expenditures, and receive alerts when nearing limits. The app also generates forecasts based on past behaviors.

For those looking to improve their credit score, QLCredit offers tailored recommendations. These suggestions are based on individual financial situations and help users take actionable steps toward enhancement. Each feature is designed to empower users in achieving better financial health without feeling overwhelmed by data.

Features and Tools Offered by QLCredit

QLCredit offers an array of features designed to simplify personal finance management. Its intuitive dashboard provides a clear overview of your financial health, making it easy to track spending habits and budget effectively.

One standout tool is the expense categorization feature. This automates the sorting of transactions into relevant categories, helping users identify areas where they can cut back.

Additionally, QLCredit’s goal-setting functionality allows users to set specific savings targets and monitor progress over time.

For those who value real-time insights, alerts notify you about upcoming bills or unusual spending patterns.

The platform also includes educational resources tailored for various financial situations—perfect for anyone looking to enhance their money management skills without feeling overwhelmed by jargon.

Testimonials from Users

Users of QLCredit have shared their transformative experiences, highlighting the app’s impact on their financial lives. One user mentioned how easy it was to track spending and create budgets, feeling more in control than ever before.

Another customer praised the intuitive interface and robust features that made managing personal finance less daunting. “I never thought organizing my finances could be this simple,” they remarked.

Many users also appreciated the real-time updates that help them stay on top of their financial goals. A consistent theme in testimonials is empowerment; individuals feel equipped to make informed decisions about their money.

With stories ranging from debt reduction success to improved savings habits, it’s clear that QLCredit resonates with a diverse audience. Community feedback showcases not just satisfaction but genuine enthusiasm for how QLCredit has reshaped their approach to personal finance management.

Comparison with Other Personal Finance Management Platforms

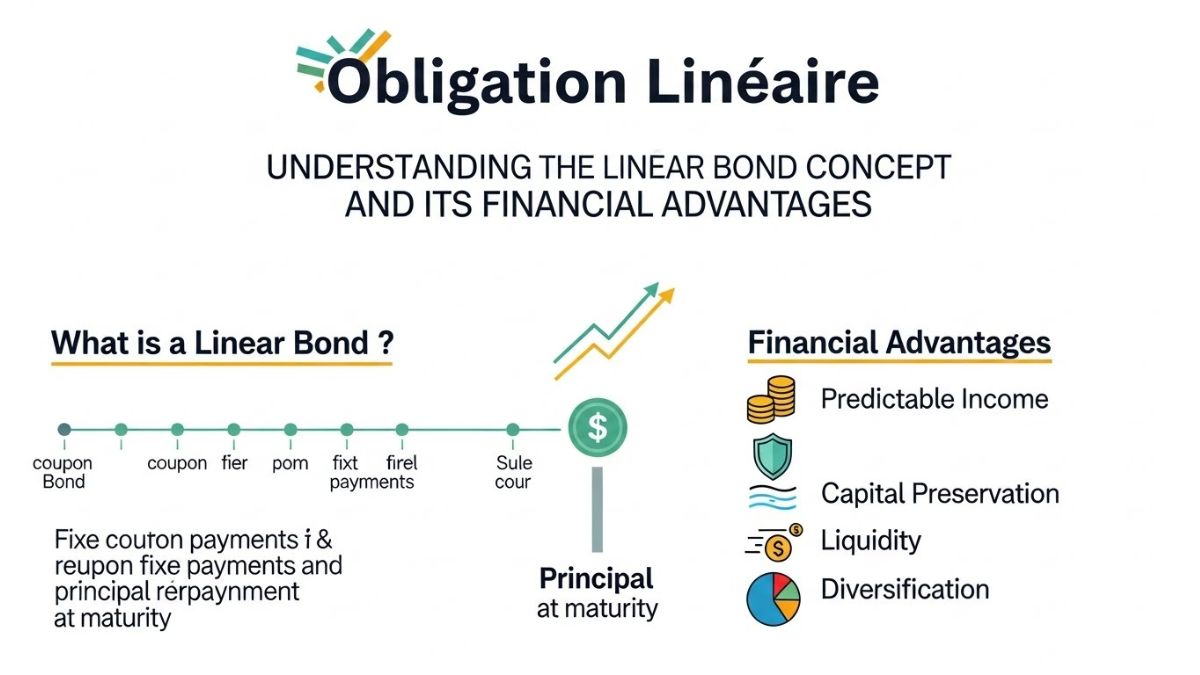

When comparing QLCredit with other personal finance management platforms, several key differences emerge. While many apps focus solely on budgeting, QLCredit provides a comprehensive approach that incorporates credit score tracking and personalized financial advice.

Other platforms may charge hefty subscription fees for premium features. In contrast, QLCredit offers a robust free tier that still delivers valuable insights into spending habits and saving opportunities.

User interface plays a crucial role in the overall experience. QLCredit boasts an intuitive design that simplifies navigation, making it accessible even for those new to financial management.

Additionally, while some competitors lack mobile functionality, QLCredit is optimized for both web and smartphone use. This flexibility allows users to track finances on the go without missing important updates or alerts regarding their financial health.

By combining features effectively, QLCredit sets itself apart as a versatile tool tailored to modern personal finance needs.

Tips for Making the Most of QLCredit

To maximize your experience with QLCredit, start by setting clear financial goals. Define what you want to achieve—whether it’s saving for a vacation or paying off debt.

Next, explore the app’s features thoroughly. Familiarize yourself with budgeting tools and spend tracking options. These can provide valuable insights into your spending habits.

Make use of alerts and reminders. Setting notifications for bill payments can prevent late fees and keep your finances on track.

Regularly review your progress within QLCredit. This helps you adapt to changes in income or expenses. Adjusting your budget accordingly ensures that you stay aligned with your financial objectives.

Engage with the community if available. Learning from others’ experiences can offer new strategies to enhance personal finance management effectively.

Conclusion:

Managing personal finances can be a daunting task. With bills, loans, and savings goals piling up, it’s easy to feel overwhelmed. Enter QLCredit—a platform designed to simplify your financial management experience.

QLCredit is an innovative tool that empowers users to manage their finances more effectively. It combines budgeting features with credit score monitoring, making it easier for individuals to take control of their financial health.

Using QLCredit comes with numerous advantages. It offers real-time insights into spending habits and helps set achievable financial goals. Users also benefit from personalized recommendations based on their unique financial situations.