The financial world offers a wide array of investment options, but one instrument that stands out for its predictability and structured approach is the obligation linéaire. This type of bond is specifically designed to provide a steady repayment of principal over its lifetime, giving investors and issuers a clear roadmap for cash flow management. Unlike other debt instruments where repayment occurs at maturity, the linear nature of obligation linéaire ensures both parties benefit from gradual and transparent repayment.

In this comprehensive guide, we will explore the structure, advantages, and applications of obligations linéaire. By the end, you will understand why it remains a preferred choice for both governments and corporations seeking financial stability.

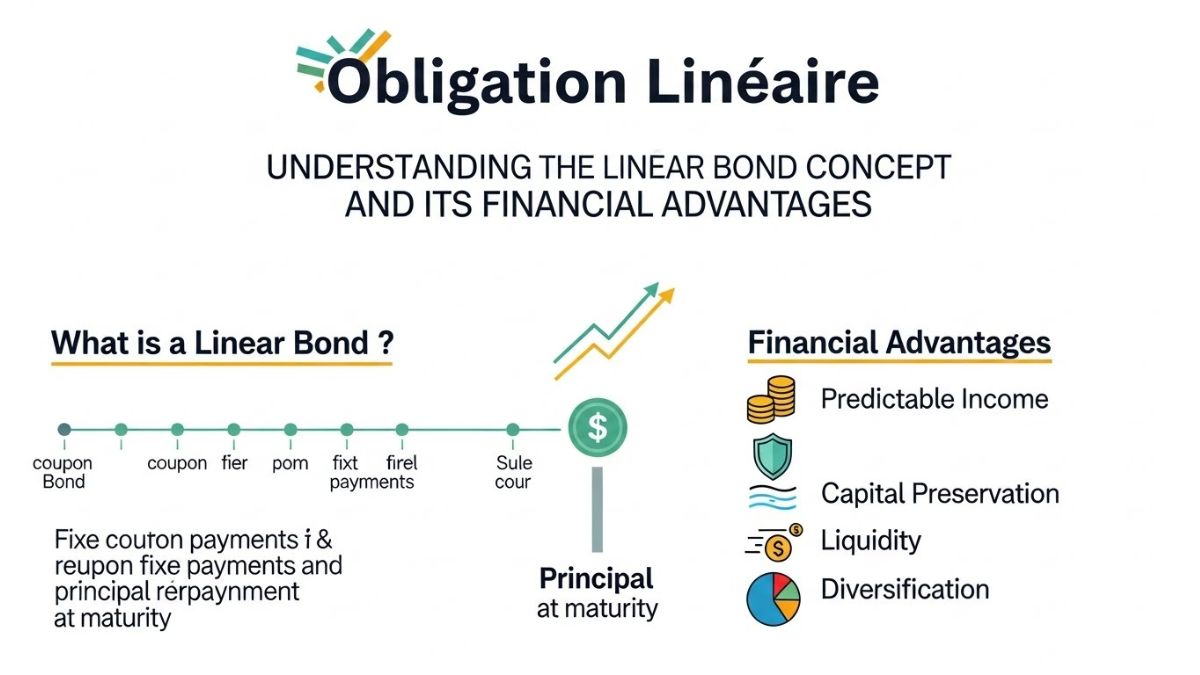

What Exactly Is an Obligation Linéaire?

An obligation linéaire is a debt security where the principal is repaid in equal installments over the bond’s life, rather than as a single lump sum at maturity. Interest is calculated on the remaining principal balance, resulting in a declining interest payment schedule.

Key Features of Obligation Linéaire

-

Gradual reduction of the principal amount

-

Predictable interest payments over time

-

Reduced financial risk for issuers and investors

-

Transparency and clear cash flow expectations

This structure contrasts with traditional bonds that require full principal repayment at the end, making obligations linéaire a more disciplined and manageable investment instrument.

How Obligation Linéaire Functions

Understanding how obligation linéaire works helps clarify its appeal to both issuers and investors.

Step-by-Step Repayment Mechanism

-

Principal Allocation: A fixed portion of the principal is repaid in each period.

-

Interest Calculation: Interest is computed on the outstanding principal balance.

-

Declining Payments: As the principal decreases, total payment amounts decrease, making early payments higher than later ones.

Financial Predictability

This structured repayment reduces uncertainty. Investors receive predictable returns, while issuers can plan cash flows effectively, minimizing financial strain.

Historical Background of Obligation Linéaire

The obligation linéaire emerged from the need for disciplined borrowing practices. Historically, governments struggled with bonds that required full repayment at maturity, causing significant financial pressure. Linear repayment models were introduced to:

-

Reduce default risk

-

Support long-term fiscal planning

-

Increase investor confidence

Over time, this model expanded into corporate financing, particularly for capital-intensive projects that require stable and long-term debt servicing.

Advantages of Obligation Linéaire

Lower Financial Risk

Gradual repayment reduces the outstanding principal over time, lowering the chance of default. Both investors and issuers benefit from this stability.

Decreasing Interest Costs

Since interest is calculated on the remaining principal, total interest paid over the life of the bond is often lower than comparable instruments.

Enhanced Investor Confidence

Predictable and structured repayments increase trust among investors, making obligations linéaire highly attractive to risk-averse market participants.

Budgeting and Planning

For governments and corporations, linear repayment allows precise cash flow planning, ensuring that financial obligations are met without surprises.

Disadvantages of Obligation Linéaire

While beneficial, obligation linéaire has certain limitations.

Higher Initial Payments

The early installments can be substantial because the interest is calculated on a larger principal.

Limited Flexibility

Once structured, altering repayment terms can be difficult, and early modifications may incur penalties.

Potentially Lower Yields

For investors seeking high returns later in the bond term, linear bonds may seem less profitable compared to bonds with deferred principal repayment.

Comparing Obligation Linéaire to Other Bonds

Obligation Linéaire vs Bullet Bonds

-

Linear bonds: Principal repaid gradually

-

Bullet bonds: Principal repaid entirely at maturity

-

Linear bonds: Lower risk early on

-

Bullet bonds: Potentially higher returns at maturity

Obligation Linéaire vs Amortizing Loans

Although amortizing loans also repay gradually, obligations linéaire is typically tradable on financial markets, making it accessible to a wider range of investors.

Practical Applications of Obligation Linéaire

Government Financing

Many governments use obligation linéaire to fund long-term projects such as:

-

Infrastructure development

-

Healthcare expansion

-

Educational programs

The gradual repayment schedule allows governments to balance budgets and reduce debt servicing risk.

Corporate Financing

Corporations employ obligations linéaire to finance large-scale projects, manage cash flow, and maintain investor trust. Its structured repayment is ideal for businesses with steady revenue streams.

Risk Management in Obligation Linéaire

Effective risk management is central to financial planning, and obligation linéaire supports this by mitigating common risks.

Interest Rate Risk

Because the interest is based on the remaining principal, the bond’s exposure to rising interest rates decreases over time.

Liquidity Risk

Gradual repayment ensures that issuers are not overwhelmed with large lump-sum payments, maintaining operational liquidity.

Investment Benefits of Obligation Linéaire

Investors integrate obligation linéaire into portfolios to reduce volatility and secure predictable income.

Why Include Obligation Linéaire in a Portfolio

-

Consistent cash flow

-

Low-risk asset allocation

-

Stability in volatile markets

This makes it an excellent choice for conservative investors, pension funds, and insurance companies.

Regulatory Considerations

Issuers of obligations linéaire must comply with financial regulations including:

-

Disclosure of terms and conditions

-

Creditworthiness assessments

-

Adherence to market transparency standards

Such regulations enhance investor confidence and support market integrity.

Future Outlook for Obligation Linéaire

The demand for transparency, stability, and structured debt repayment continues to grow globally. As financial markets evolve, obligation linéaire is likely to maintain its relevance, particularly in sustainable finance and long-term infrastructure projects. Innovations in digital finance could further streamline issuance, tracking, and trading of these bonds.

Common Misconceptions About Obligation Linéaire

It’s Only for Governments

In reality, corporations and financial institutions increasingly use obligation linéaire to raise capital.

It Provides Low Returns

While returns may appear moderate, the reduced risk and predictable cash flow often result in favorable risk-adjusted returns.

Conclusion: The Value of Obligation Linéaire

Obligation linéaire offers a disciplined, transparent, and reliable approach to debt repayment. Its gradual principal reduction, declining interest payments, and predictability make it an appealing option for governments, corporations, and investors alike. By prioritizing stability and long-term planning, obligation linéaire remains a cornerstone of responsible financial management in both public and private sectors.

Investing or issuing in this instrument ensures reduced financial risk, increased investor confidence, and sustainable growth, demonstrating why it continues to be a trusted financial tool.