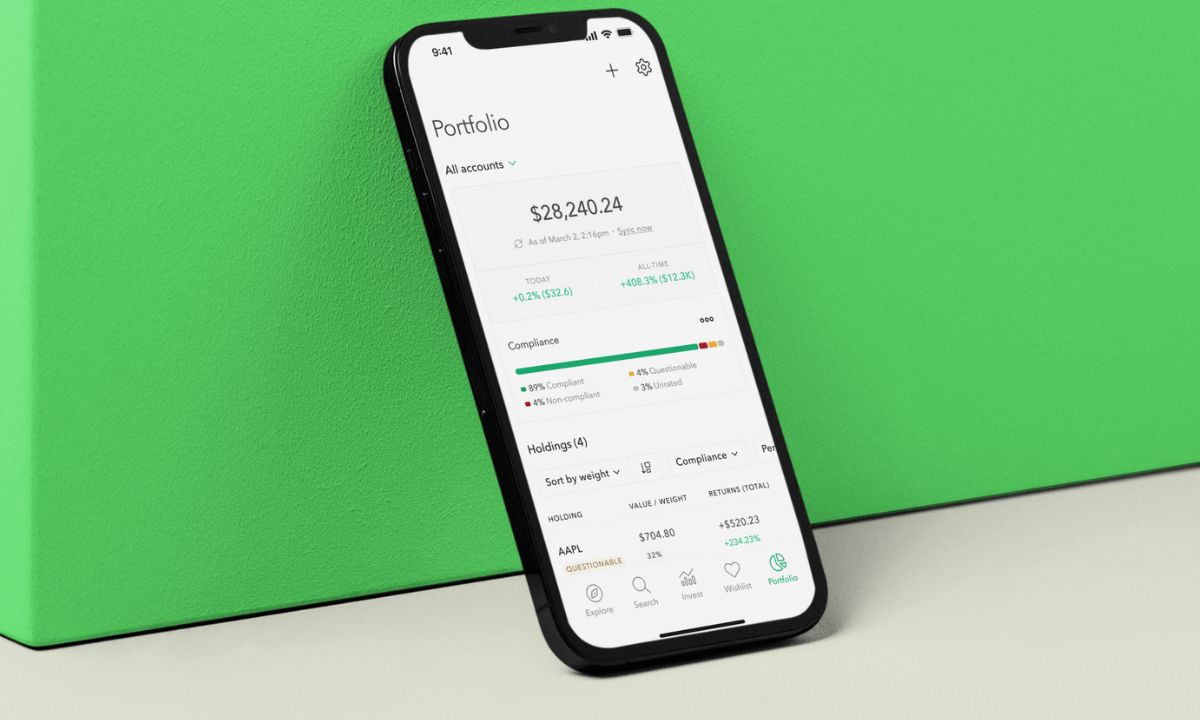

As the global Islamic finance market continues to grow, innovative Halal investment options are emerging, offering exciting opportunities for ethical investors. By exploring a range of Sharia-compliant investments, you can create a robust portfolio that withstands market fluctuations and supports your financial goals. Let’s explore diverse Halal investment ideas and five key benefits of embracing diverse Halal investment ideas, and how they can transform your approach to ethical investing.

- Risk Mitigation

Spreading your investments across various Halal asset classes acts as a financial safety net, cushioning your portfolio against market volatility.

Think of it like preparing a diverse feast – if one dish doesn’t turn out well, you’ve got plenty of other options to enjoy. By investing in a mix of Sukuk, Islamic ETFs, Halal stocks, and real estate, you’re not putting all your eggs in one basket. This approach can help smooth out the ups and downs of individual investments, potentially leading to more stable returns over time. Remember, even within the realm of Halal investing, different sectors and asset types respond differently to economic conditions. A well-diversified portfolio can help you weather financial storms with greater resilience.

- Enhanced Potential for Returns

Diversification in Halal investments isn’t just about playing defense – it can also boost your offensive game in the pursuit of returns.

Different Halal investment vehicles have varying risk-return profiles. By carefully selecting a mix of investments, you can potentially capture gains from high-growth areas while maintaining a foundation of stability. For instance, you might balance the steady income from Sukuk with the growth potential of Sharia-compliant technology stocks. This approach allows you to participate in various market opportunities while staying true to Islamic principles. It’s like being a smart chef who knows how to combine ingredients for the best flavor – in this case, the best financial outcomes.

- Alignment with Evolving Market Trends

A diverse Halal investment portfolio positions you to capitalize on emerging trends in the global economy while maintaining your ethical standards.

The world is changing rapidly, and with it, new investment opportunities are arising that align with Islamic principles. From Islamic fintech startups to green Sukuk for sustainable projects, diverse Halal investments allow you to tap into innovative sectors. By staying open to these opportunities, you’re not just investing – you’re participating in the evolution of ethical finance. It’s like having a front-row seat to the future of Halal investing, with the potential to benefit from groundbreaking ideas and technologies.

- Improved Liquidity Management

Diversifying across different Halal investment types can provide better control over your liquidity needs.

Some Halal investments, like certain types of Sukuk or Islamic savings accounts, offer relatively easy access to your funds. Others, like real estate or private equity investments, may tie up your capital for longer periods but potentially offer higher returns. By maintaining a mix, you can ensure you have access to funds when you need them while still pursuing long-term growth. It’s similar to managing your wardrobe – you have clothes for different occasions, from everyday wear to special events. In the same way, a diverse investment portfolio lets you balance your short-term and long-term financial needs effectively.

- Ethical Impact Across Multiple Sectors

Embracing diverse Halal investment ideas allows you to make a positive impact across various industries and communities.

When you diversify your Halal investments, you’re not just spreading financial risk – you’re spreading your potential for positive influence. By investing in a range of Sharia-compliant options, you can support ethical practices in multiple sectors, from sustainable agriculture to Islamic education technology. This approach allows you to contribute to the growth of the Halal economy on multiple fronts. It’s like planting a diverse garden – each investment has the potential to bloom and bear fruit, contributing to a more vibrant and ethical economic ecosystem.

By embracing these diverse Halal investment ideas, you’re not just building wealth – you’re crafting a financial strategy that reflects your values, manages risk effectively, and positions you to benefit from the dynamic world of ethical investing. Remember, the key to successful diversification is ongoing learning and adaptation. Stay informed about new Halal investment opportunities, regularly review your portfolio, and don’t hesitate to seek advice from Islamic finance experts. With a thoughtful, diverse approach to Halal investing, you can work towards financial success while staying true to your principles.

ALSO READ: FSI Blog: Your Ultimate Guide to Financial Services Insights