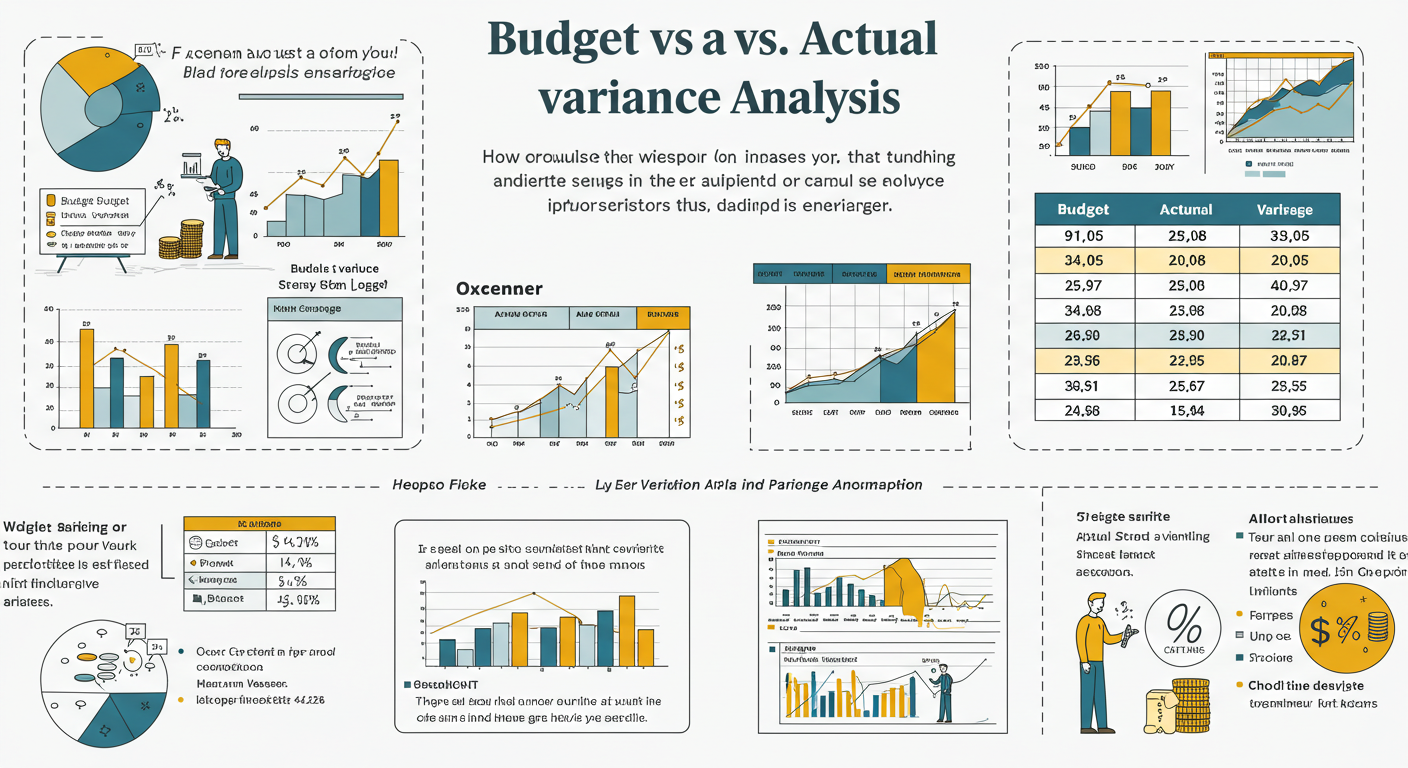

In today’s dynamic business environment, understanding financial health is crucial for making informed decisions. Budget vs Actual Variance Analysis emerges as a fundamental process that addresses this need by offering insights into a company’s fiscal performance.

The challenge many organizations face is identifying where differences between planned and actual figures occur and interpreting those disparities effectively. This article delves into the intricacies of budget variance analysis, explaining its significance and methods, including how to identify favorable and unfavorable variances, explore their root causes, and utilize this understanding for strategic advantage.

By navigating these sections, businesses can better harness their financial data for enhanced performance outcomes.

Understanding Budget vs Actual Variance Analysis

When it comes to financial management, budget vs actual variance formula and its analysis. It is a valuable tool that no business should overlook. At its core, this practice involves comparing what was planned—your budgeted numbers—with what actually occurred. This simple yet powerful comparison enables businesses to assess their financial performance and provides insights to guide important decisions.

- Definition and importance of comparing actual results with budgeted expectations

When we’re talking about variance, we’re essentially looking at the differences between what we expected to happen financially and what did happen. It helps identify those discrepancies that may appear in everyday operations and financial outcomes. - Purpose of budget variance analysis

Through budget variance analysis, businesses can understand their strengths and weaknesses better. By examining the causes of variances, they can figure out what led to better performance or where things went off track. This isn’t just about looking back, though; it’s about using past data to forecast more accurately and adjust plans moving forward, ensuring that financial goals are met efficiently.

Different Types of Budget Variances

In the world of finance, recognizing the different types of budget variances is essential for evaluating an organization’s financial health. Budget variance analysis reveals whether an organization’s actual performance aligns with its expectations, offering valuable insights for future business strategies.

Favorable Variance

When actual performance outperforms what was anticipated, it results in a favorable variance, which benefits the organization. For instance, if a company predicted $900,000 in sales but secured $921,000, the sales budget variance increases favorably by $21,000.

- Reasons for such a surplus could include:

- Increased demand

- Impactful marketing strategies

- Successful product launches

- Additional favorable examples:

- Operating expenses like selling, general, and administrative costs come under budget, such as an $8,000 saving from a planned $240,000.

- Reducing manufacturing overhead from a forecasted $400,000 to $393,000 demonstrates better resource allocation and efficiency.

Unfavorable Variance

On the contrary, an unfavorable variance emerges when actual outcomes fall short of the budgeted expectations, possibly affecting profitability. For example, if sales were budgeted at $200,000 but only $180,000 was achieved, this indicates an unfavorable sales variance of $20,000 or 10%.

- This gap might result from:

- Economic downturns

- Ineffective marketing

- Declining consumer interest

- Additional unfavorable examples:

- When actual expenses surpass budgets—like spending $60,000 on raw materials instead of the budgeted $50,000—it indicates cost overruns or inefficiencies.

Budget variance types also encompass volume and price variances. Volume variances arise when production or sales volumes exceed predictions, while price variances stem from differences between actual and expected selling prices per unit. Tracking these variances offers insights for strategy.

Causes of Budget Variance

Budget variance can occur due to several reasons, each impacting a company’s financial performance uniquely. One significant cause is market shifts, where economic conditions or changes in demand can drastically alter budget expectations. For instance, unexpected increases in the prices of raw materials or labor can result in substantial variances between anticipated spending and actual costs. Similarly, if a company bases its revenue predictions on outdated market data, overestimated revenues can lead to unmet financial targets.

Unplanned Expenses

Unexpected costs like emergency repairs

Unplanned expenses often contribute to budget variances as well. Unexpected costs like equipment failures, unplanned maintenance, or natural disaster recovery can necessitate the reallocation of funds originally intended for other expenses. Regulatory changes, legal fees, or disaster-related expenses also fall into this category, disrupting the planned financial framework of a business.

Operational Inefficiencies

Increased costs due to process delays

Operational inefficiencies, such as process delays or supply chain bottlenecks, can inflate costs unexpectedly. For example, a manufacturing plant facing delays might incur higher overtime costs or experience shipment delays, hurting both immediate financial metrics and customer satisfaction. As highlighted in a Reddit discussion, adapting to these inefficiencies can be challenging since traditional variance methods may not account for unpredictable variables.

Inaccuracies

Errors in forecasting and budgeting

Inaccuracies in forecasting and budgeting remain a common source of variance. Errors, whether through human input or data interpretation, result in discrepancies that disrupt financial planning. The reliance on outdated or inaccurate data can lead to flawed assumptions, exacerbating budget challenges.

External Factors

Regulatory changes and competitive pressures

External factors such as regulatory changes and competitive pressures also cause significant budget variances. New regulations may introduce unforeseen compliance costs, while competition could force companies to shift strategies, impacting their budget structure. More than half of businesses are primarily concerned with economic conditions and competitive pressures, highlighting how external dynamics influence budget outcomes (Source).

Each of these factors demonstrates how complexities in market conditions, internal operations, and external influences can converge, leading to budget variances that businesses must carefully monitor and address.

Steps for Calculating Budget Variances

Variance Calculation Formula: Actual Amount – Budgeted Amount

To get started with budget variance analysis, you first need to understand the basics of the formula: Variance = Actual Amount – Budgeted Amount. This simple and direct calculation reveals the difference between what you projected and what really happened.

Percentage Variance Formula: Calculated as (Actual ÷ Budgeted) – 1

While knowing the raw number is helpful, converting this into a percentage can make it easier to interpret in relation to the overall budget. This is done using the formula: Variance % = ((Actual / Budgeted) – 1) * 100. For instance, understanding that spending $1,000 more than expected affects a $10,000 and $100,000 budget differently is essential for nuanced insights.

Example Calculations: Interpretation of Negative and Positive Variances

Knowing the raw numbers is one thing, but understanding their implications is another. Positive variances, such as spending less than budgeted, suggest efficient resource management — a favorable outcome. Conversely, negative variances, like overspending, may indicate areas for improvement.

For better clarity on these calculations, the YouTube video ‘Variance Analysis Explained’ https://www.youtube.com/watch?v=x0E7L334-w0 is an excellent resource that walks through these nuances in detail, especially helpful for visual learners looking to grasp the differences between negative and positive variances.

Applying Variance Analysis in Real-World Scenarios

Performing variance analysis is a crucial part of financial management, helping organizations compare their budgeted figures against actual results. It highlights deviations and offers insights for improvement.

To begin, gather both budgeted and actual data for the period under review. Automation tools like Mosaic and Vena Solutions can streamline data collection by automatically syncing operational and financial data, reducing manual errors and saving time.

Next, calculate the variances. Use formulas to ascertain the differences between budgeted and actual values. For instance, Rate Variance and Volume Variance help in pinpointing the specific areas of deviation, such as differences in rate versus volume, using their respective formulae as outlined. It’s helpful to understand if a variance is favorable or unfavorable: a positive revenue variance typically suggests a favorable outcome, while a positive expense variance is often seen as unfavorable.

After calculation, the analysis of the results is paramount. This involves performing a root cause analysis to pinpoint the underlying causes of significant variances, whether they stem from market conditions, operational inefficiencies, or other factors. Setting up thresholds and alerts can assist in swiftly identifying substantial deviations, contributing to effective management responses.

Two essential tools in variance analysis are spreadsheets and dashboards. Spreadsheets, particularly Excel, come in handy with their capability to use formulas, pivot tables, and advanced features like conditional formatting and macros to enhance data analysis. Add-ins, such as Beebole’s Excel add-in, further streamline data capturing and analysis processes.

Dashboards offer a centralized view of data, facilitating real-time data visualization and collaboration. Tools like Mosaic provide intuitive platforms for real-time insights that can be shared with colleagues and stakeholders, fostering collaboration and alignment in financial goals. Interactive dashboards allow users to dive deeper into data, enabling detailed investigative work into the cause of variances.

These analyses promote accountability within organizations by aligning actual performance with budgeted targets. Over time, leveraging financial management tools ensures that variance analysis not only becomes more efficient but also instrumental in guiding business strategy and decision-making processes.

For a comprehensive understanding of approaches to calculating variances, you can explore insights from discussions on Reddit where individuals share varied methodologies tailored to different financial contexts.

Simple budget – YTD vs Actual and Variance

by u/sillysimms in AskAccounting

Interpreting Budget Variances

Properly interpreting budget variances involves a comprehensive process of identifying and understanding the differences between your expected and actual financial performance. The journey involves not just spotting these discrepancies, but also taking a deep dive into the underlying causes and shaping strategic responses.

Identify Causes:

Start by analyzing the driving factors behind variances. Are they being influenced by changing market conditions, operational inefficiencies, or unexpected expenses? It’s crucial to determine if a variance is simply a result of timing or if it truly represents an over or underspend. By pinpointing why these variances have occurred, you can take informed steps toward addressing them effectively.

Report Findings:

Once you have identified the causes, prepare insightful management reports. Categorize variances clearly, using visual aids like conditional formatting to distinguish between favorable (green) and unfavorable (red) variances quickly. An executive summary accompanying these reports can succinctly capture the key variances and provide a detailed breakdown in both monetary and percentage terms.

Make Strategic Adjustments:

Leverage the insights gained from variance analysis to make strategic adjustments. Favorable variances signal strategies that deserve replication—perhaps a marketing campaign that exceeded expectations. In contrast, unfavorable variances necessitate corrective actions by tackling root causes, which may involve enhancing production efficiency or refining processes. The outcome is not merely about resolving issues but modifying strategies to avert future discrepancies.

In a rapidly changing business environment, real-time variance analysis is essential for agile decision-making. For example, analyzing sales data can unveil shifts in customer preferences, prompting timely pivots in marketing or product offerings. This approach ensures that businesses remain adaptable and responsive. Source

Furthermore, employing a robust risk management framework becomes necessary. It encompasses continually identifying, assessing, and mitigating potential risks contributing to unfavorable variances. By conducting benchmark comparisons and cost-benefit analyses of new initiatives, organizations can align with budget goals while minimizing unnecessary expenditures.

Ultimately, the goal is to nurture a culture of continuous innovation and financial prudence. This involves enhancing employee accountability through aligned performance metrics and transparent reporting to stakeholders. Regular communication of variance insights keeps everyone—from investors to employees—informed and working towards common financial objectives. Industry discussions, such as those shared by financial professionals on platforms like Reddit, highlight the importance of historical data and collaboration with business partners in refining variance strategies.

How do you do variance commentary for Budget vs Actuals?

by u/lidell786 in FPandA

By mastering variance interpretation, businesses can significantly improve their operational efficiency and strategic resilience.

Best Practices for Budget Variance Analysis

Regularly reviewing and adjusting your budget

Regularly reviewing and adjusting your budget is a foundational practice for effective budget variance analysis. By conducting this analysis frequently—monthly or quarterly— you can remain agile in the face of changing conditions. For example, if market conditions shift unexpectedly, having established routines for analyzing your budget allows you to adjust swiftly and maintain financial stability.

Clear Communication

Communicating clearly with stakeholders is equally important. This means tailoring how you report budget variances to align with your audience’s level of financial expertise. Executives may prefer dashboards or summary reports for a quick overview, while financial teams might benefit from detailed explanations and breakdowns. Providing context is crucial; a report that only states the variance lacks meaning. By explaining why a variance happened—whether due to unforeseen expenses, market changes, or other factors—you help everyone understand the real implications.

Focus on Controlling Key Variances

A practical focus should be on controlling key variances: those related to expenses and revenues. Not all variances require equal attention, but identifying and addressing those that significantly affect your budget can lead to impactful adjustments. For instance, if a direct revenue stream shows significant variation from the budget, investigating it could reveal essential insights that inform strategic decisions.

To manage these variances effectively, integrate tools that merge data seamlessly with other financial systems. This reduces discrepancies, fosters more accurate analyses, and allows a faster response. Additionally, employing visual tools like graphs and dashboards can make data analysis more intuitive, helping to identify patterns and anomalies quickly.

By embedding variance analysis into the organizational culture, fostering a data-driven approach, and engaging multiple departments, you promote a unified effort towards continuous improvement. This collaborative atmosphere can lead to better financial management practices and align budget adjustments with the organization’s strategic goals.

- Empowering stakeholders through regular training

- Involving them in the budgetary process ensures everyone understands their role in achieving these goals

- Subsequently increasing both transparency and accountability across the organization

Strategic Value of Budget Variance Analysis

Budget variance analysis is more than just a comparison of numbers; it’s a strategic lens through which businesses can gain financial clarity and steer their decision-making processes effectively. It helps identify performance discrepancies, revealing operational strengths and weaknesses.

By consistently monitoring these variances, businesses not only track their performance but also uncover trends that can help predict future outcomes with greater accuracy.

Adaptability and Strategy

The real power of budget variance analysis is realized when companies use these insights to adapt their strategies. Knowing variance causes helps realign actions with objectives. This adaptability is crucial for ensuring sustained success, particularly in today’s volatile market environments. Ongoing assessment equips companies to tackle challenges and grow.