A single advanced machine can process more data in one minute than a human investor could analyze in a lifetime. It reads patterns you cannot see, reacts faster than you can blink, and learns from information you didn’t even know existed. If you still believe your personal knowledge gives you an edge in the financial markets, your future strategy may already be outdated.

AI is not coming. It is already here, shaping how money moves between governments, corporations, hedge funds, and individuals. The balance of power is shifting toward those who control data and the tools that turn it into action.

The question is simple. Are machine learning and AI making it impossible for individuals to survive in financial markets, or is there still room to adapt and find new paths?

How AI Changed the Structure of Financial Markets

AI reshaped the entire structure of how things are done. Markets once moved on human analysis, news, and experience. Now they react to signals captured by machines that never sleep and never stop learning.

Large firms use machine learning models that scan massive data sets in real time. They read price movements, social trends, company reports, satellite images, shipping data, and even weather patterns. What a human needs hours or days to study, an AI model digests in seconds.

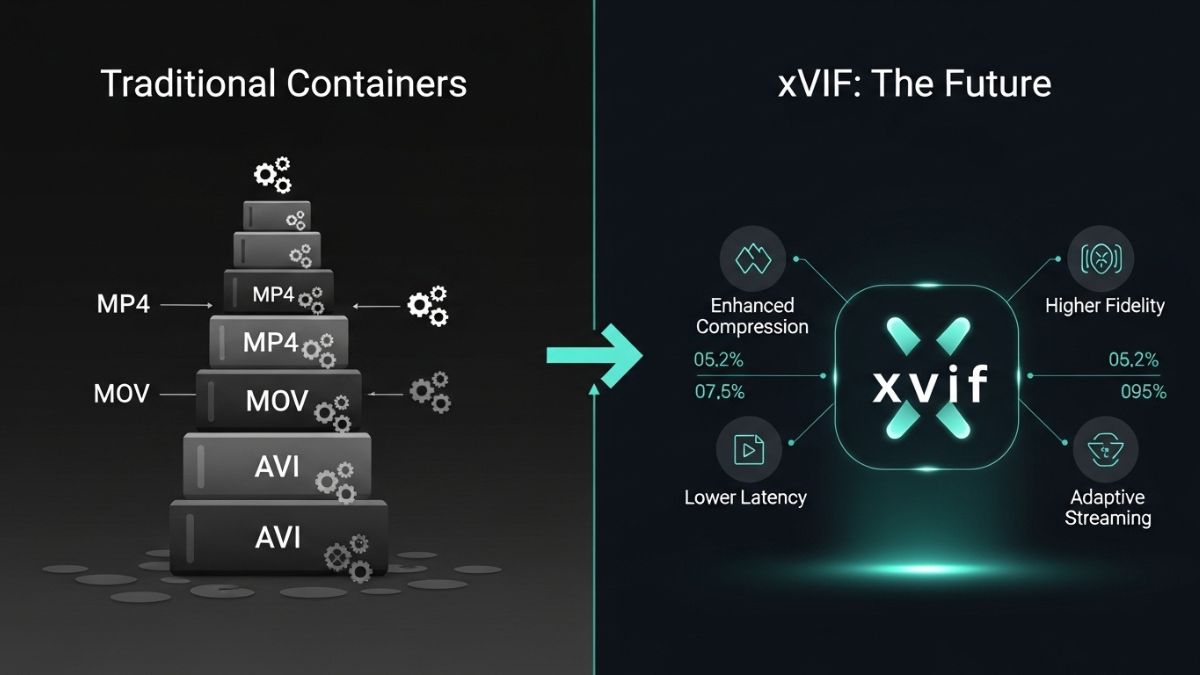

Execution changed as well. Algorithms identify opportunities and send orders instantly. They adjust positions the moment conditions shift. No hesitation. No emotion. No delay. This speed creates a world where small inefficiencies disappear before an individual even notices them.

The result is a system where human traders operate in the shadows of powerful machines. The game has become faster, deeper, and more complex. The tools that big players use are beyond anything an ordinary person can match on their own.

The End of the Old Investment Era?

There was a time when patience, discipline, and simple strategies were enough to beat the market. A careful investor could read annual reports, follow economic cycles, and make decisions with a calm mind. Today that world barely exists. AI-driven systems react before humans even start thinking.

Markets no longer reward slow interpretation. They reward speed. They reward data. They reward models that find patterns too small or too complex for the human eye. Algorithms adjust portfolios in milliseconds, identify inefficiencies instantly, and respond to signals humans never notice.

This does not mean long-term investing is dead. It means the battlefield has changed. The old methods work less reliably because the competition is no longer between people. It is between people and machines trained with information at a scale humans cannot match.

The golden age of simple investing may be fading, but a new age is forming. One where humans must rethink their role, adapt to new tools, or find safer ways to navigate markets ruled by algorithms.

Options for the Individual Investor: Three Survival Paths

AI changed the game, but it did not remove individuals from the board. It simply forced everyone to choose how they want to survive in a market shaped by machines. You cannot compete with high-speed models or data centers, but you can choose a path that fits your skill level, your risk tolerance, and your personality.

Some people avoid the new reality. Some adapt by changing their style. Others learn enough to use the system instead of fighting it. There is no perfect answer. There are only choices that match your strengths.

Path 1: Stay Away from Financial Markets

If the speed of modern markets feels overwhelming, avoiding them is a valid strategy. You can focus on physical assets that are not influenced by algorithmic activity.

- Real estate

- Land

- Gold or silver

- Collectibles or tangible stores of value

These assets move slower. They are not driven by microsecond reactions. They rely more on human behavior and long-term demand. You lose the excitement of fast gains, but you also escape the stress of competing with machines.

Path 2: Trade Short-Term, Not Long-Term

Some individuals decide to play the game but change how they participate. Instead of long-term predictions, they focus on price movements and short windows of opportunity.

Short-term trading avoids the part of investing that AI dominates. You are not trying to forecast the next decade. You are reacting to what is in front of you today.

Skills that matter here:

- Understanding volatility

- Reading technical behavior

- Using proper risk management

- Keeping emotions under control

- Applying simple hedging strategies when needed

So, you can trade in small portions, protect your capital, and stay flexible.

Path 3: Learn, Adapt, and Invest Smarter

The third path accepts that AI is part of the new financial world and works with it instead of fighting it. You become an informed investor who uses the tools available.

This path includes:

- Investing in index funds

- Holding diversified portfolios

- Using robo-advisors or AI-supported platforms

- Following professional fund managers who already use machine learning

- Building your own financial literacy

You are not trying to outrun the machines. You are letting them work in your favor while you stay focused on strategy, patience, and long-term stability.

How Can AI Support Individuals?

AI may dominate the fast side of finance, but it can also work as a powerful assistant for ordinary investors. Instead of trying to compete with machines, individuals can use them to make better decisions.

AI tools can help simplify complex choices. Portfolio platforms can analyze risk levels, suggest adjustments, and rebalance holdings automatically. Market scanners can filter opportunities that match your style without forcing you to study hundreds of charts. Even basic prediction models can highlight trends that would take hours to identify by hand.

AI can also remove emotional noise. Many losses happen because people panic or chase excitement. They ignore fear and greed.

Education is another advantage. AI can explain concepts, break down financial news, and personalize learning. It gives people access to knowledge once available only to professionals.

Overall, machines are not our enemy. They’re a support system that closes our gaps.

The Human Edge in an AI-Driven Market

AI dominates speed, data, and pattern recognition. Yet humans still hold strengths that machines cannot fully replace. The future of finance is about understanding what each side does best and combining them wisely.

Below are the three parts of that balance:

Human Strengths That AI Cannot Replace

People understand context in a way machines cannot. You can read the mood of a crisis, sense market tension, interpret political events, or recognize when something feels “off,” even when the data looks fine.

Intuition still matters. Human investors often succeed during chaotic periods because they see the bigger picture. AI may detect trends, but you understand meaning. That helps you avoid crowded trades that algorithms create when too many models chase the same idea.

Flexibility is another advantage. You are not tied to institutional mandates, fixed rules, or forced exposure. You can pause, shift, or stay out of the market entirely. Emotion can be a weakness when poorly managed, but in extreme panic or extreme greed, emotion becomes a warning signal that machines cannot feel.

New Risks in the AI-Controlled Market

The rise of machine-driven trading also creates challenges for individuals. Markets move at speeds that leave no room for slow reactions. Algorithms can trigger large moves in seconds, creating flash crashes or sudden spirals.

When many models are trained on similar data, they often behave the same way. This creates herd behavior that magnifies trends and reversals. Transparency is another issue. AI decisions often come from models that even their creators cannot fully explain. This makes the market harder to read and harder to trust.

These risks do not make markets impossible, but they do require awareness. Individuals must understand that volatility can be driven by machines reacting instantly instead of humans thinking slowly.

Balanced Reality: Humans and Machines Together

The future of finance will not belong to only one side. AI will continue to dominate data processing, speed, and short-term execution. It will see patterns people cannot see and act in moments when humans are still thinking.

Humans will continue to lead strategy, timing, philosophy, and long-term judgment. People decide the bigger picture. Machines handle heavy lifting inside it.

The winners will be the ones who combine both. Those who use AI tools for trading analysis but rely on human reasoning for big decisions. Those who understand their own psychology and know when to step back. Those who learn to use technology without letting it control them.

Conclusion: Adapting to the New Machine-Driven Era

AI and machine learning are rewriting the rules of global finance. But it does not mean individuals are finished.

People still carry strengths that machines cannot imitate. Context, intuition, patience, and long-term thinking remain human advantages.

The future belongs to those who adapt. You do not need to compete with algorithms. You only need to understand how they change the landscape and choose the path that fits your skills.